Compare Life Insurance Quotes Online

No phone number required + exclusive 10% Cashback*

Start Saving Money by Comparing Life Insurance Quotes Hassle Free

Review your insurer for a chance to win an apple watch

Save 10%*

Why use Insurance Watch?

Find the cheapest deal from our range of top Australian insurers/brands and get 10% cashback – you won’t get this going direct

5 Step Guide to comparing life insurance

STEP 1

What type of cover do I need?

Understand what is covered:

- Life (Death) – lump sum if you die

- TPD – lump sum if you can no longer work

- Trauma – lump sum to manage the costs of a serious illness

- Income Protection – monthly payments to meet expenses/maintain lifestyle over short term or long term

What covers are important to you?

STEP 2

How much cover should I have?

Work out your Insurance Needs and Goals:

- Pay expenses – funeral or medical

- Pay off debts

- Replace lost income

- Cover future education costs

Offset existing assets:

- Savings

- Superannuation

- Existing insurance covers

STEP 3

What will the cover cost?

Compare and shop smart:

- Free Life Insurance comparison service

- Online quotes from up to 9 insurance brands

- No annoying phone calls

- Insurance Watch 10% cashback, or 5% ongoing discount

- Find cover to suit your budget

STEP 4

Which policy will suit me?

Research policy differences:

STEP 5

How do I apply for cover?

Choose how to apply for your policy:

- Online

- Over the Phone

(Usually Medicals will not be required)

Help from us after the application:

- Ongoing policy management

- Assistance with lodging claims

Compare Life Insurance Quotes

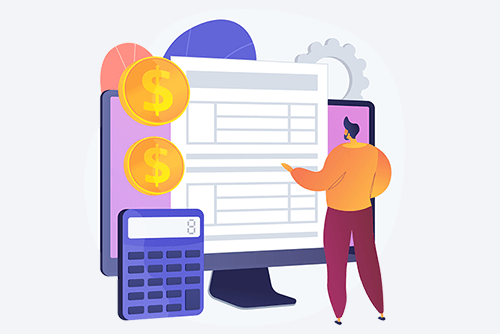

Top 3 Cheapest Premiums – Insurance Watch

| Male Monthly Premium | ||

|---|---|---|

| ClearView Life Insurance | $ 25.15 | |

| Zurich Life Insurance | $ 25.85 | |

| OnePath Life Insurance | $ 26.81 |

| Female Monthly Premium | ||

|---|---|---|

| ClearView Life Insurance | $ 20.58 | |

| Zurich Life Insurance | $ 20.78 | |

| Acenda (formerly MLC) | $ 21.79 |

Direct Life Insurance Brands

| Male Monthly Premium | Female Monthly Premium | |

|---|---|---|

| AHM Life Insurance | $ 45.93 | $ 40.00 |

| Medibank Life Insurance | $ 46.86 | $ 40.80 |

| AAMI Life Insurance | $ 60.96 | $ 48.16 |

| Suncorp Life Insurance | $ 60.96 | $ 48.16 |

| Insuranceline | $ 64.17 | $ 50.69 |

| Allianz Life Insurance | $ 66.73 | $ 51.38 |

| HCF Life Protect | $ 89.00 | $ 66.50 |

| Kogan Life Insurance | $ 99.90 | $ 84.71 |

| Real Life Insurance | $102.14 | $79.45 |

| Guardian Life Insurance | $105.90 | $89.79 |

Monthly Premiums for $500,000 Life Insurance for a 45 year old, non-smoker as at 4th June 2025 (excludes membership or other discounts and before the Insurance Watch 10% Cashback/5% ongoing discount*)

Pay Your Premiums With Super

Many of the insurance companies we feature will allow your Life/TPD insurance and Income Protection insurance premiums to be paid out of your existing superannuation fund or SMSF. Some insurers will even give you a 15% discount if you pay in this way. Interested? Compare life insurance quotes or seek advice from one of our qualified advisers.

Tax Deductions

Tax deductions can be handy at tax time. Did you know that income protection insurance premiums can be fully tax deductible? This means when considering the cost of income protection you should look at the after tax cost. We show you the savings you can make by claiming your tax deduction. Compare income protection quotes and find a great deal.

Hot Topics

Frequently

Asked

Questions

What is Life Insurance and TPD Insurance?

Cover for death, terminal illness and total and permanent disability (TPD). Find out how to compare Life and TPD insurance policies

What is Income Protection Insurance?

Cover for an illness or injury which stops you from working and being able to earn an income. Find out how to compare income protection policies

What is Trauma Insurance?

Cover for a number of major illnesses such as cancer, heart attack and stroke. Find out how to compare trauma insurance policies

How much does Life Insurance cost in Australia?

In June 2025 the average cost of $500,000 life insurance cover for a 45 year-old, male non-smoker was between $25.15 and $36.87 a month for policies from Insurance Watch. The same insurance cost $45.93 to $105.90 a month from a range of “direct to the public” brands promoted on TV and social media. See premium comparison

Which is the best Life insurance in Australia?

The “best” life insurance policy for you will depend upon your age, gender, smoker status, pastimes, health and occupation. As insurers rate these differently it is important to compare premiums from a range of insurers, as well their policy benefits, claims statistics and customer reviews. To find the right policy to meet your needs you should research your options and if required seek advice.

Who has the cheapest Life insurance?

Policies from life insurance advisers/brokers are generally cheaper than buying direct life insurance policies. While superannuation funds can also provide low cost insurance cover they are not necessarily the cheapest. The best way to find the cheapest cover is to shop around.

How do you compare life insurance and find the best value deals?

To find the best deals ensure that you are comparing policies from a wide range of insurers, including the largest life insurance companies in Australia. Compare quotes online so that you are not pressured into a purchase over the phone. Check what incentives and discounts are on offer to lower the price.