Life insurance and TPD insurance

Life insurance is also Known as term life insurance, or death insurance

What is Life Insurance?

Life insurance provides a cash lump sum to your loved ones in the event of your death.

If you are diagnosed with a terminal illness and have less than 12 months to live, the insurer may pay the benefit directly to you.

Life cover normally applies immediately for any cause of death, whether accident or illness, with the exception of suicide occurring within the first 13 months.

Find out how much life insurance cover costs

For those not eligible for full life cover there are limited Accidental Death or Accident Only Life insurance policies available which only cover death resulting from an accident. However according to the Australian Institute of Health and Welfare accidents account for only around 8% of total deaths.

Life insurance premiums generally increase each year as you get older (i.e. are stepped), however level premiums are also available.

What is Total and Permanent Disability (TPD) Insurance?

Total and Permanent Disability, or TPD, insurance provides a cash lump sum if you suffer a permanent disability arising from an illness or injury and this prevents you from ever working again. Usually you will need to have not worked for a period of three or six months before you can make a claim.

Find out how much TPD life insurance cover costs

TPD cover is usually purchased as an optional extra on a Life insurance policy. The Life and TPD insurance covers are “linked” which means that you are paid a cash lump sum only on the first of death or TPD to occur. For this reason the amount of TPD cover is normally limited to the amount of life cover purchased, however standalone TPD insurance cover can be purchased separately if life cover is not required.

There are different types of TPD insurance. The most common are “Any Occupation” and “Own Occupation” which are explained below.

The cost of TPD insurance cover will be higher if you work in an occupation which requires manual work or involves other risks, such as working at heights or underground. Commonly claimed TPD conditions reported by insurance companies are permanent back injuries and mental illnesses.

Why do I need Life and TPD insurance?

The purpose of life insurance is to protect your dependents from financial loss in the event of your death. The proceeds of the policy can be used to repay debts, pay for funeral costs, pay for future education costs and replace future income lost. Term life insurance is very economical cover, particularly if taken out while young and healthy.

Estimate how much Life and TPD cover you may need

TPD insurance can be used to protect both you and your family from financial loss in the event a serious and permanent disablement prevents you from working again. In this case your family has to continue to meet living expenses and debt obligations without your income. They may also have to pay for any costs associated with your disability such as medical fees, home modifications and ongoing care. TPD insurance will provide a cash lump sum that you and your family can use to repay debt and/or draw down on over time.

What is the Difference between TPD, Trauma and Income Protection?

A package of Life, TPD, Trauma and income protection will provide the most comprehensive cover against the risk of disability or death.

However, if you cannot afford all of these covers your individual circumstances will determine which are a priority for you.

How much does Life Insurance cost?

The main factors affecting the premiums quoted for Life insurance are:

- Age

- Gender

- Smoker status

The table and graphs below show the range in cost for Life Insurance for males and females at different ages based on $1,000,000 Life insurance coverage and non-smoker rates (as at 5th January 2026).

Monthly Cost of $1,000,000 Life Insurance – Range from Lowest to Highest

|

Age |

Male Non Smoker |

Female Non Smoker |

|---|---|---|

|

20 |

$42 to $82 |

$25 to $61 |

|

25 |

$32 to $70 |

$20 to $45 |

|

30 |

$26 to $52 |

$19 to $38 |

|

35 |

$25 to $47 |

$20 to $38 |

|

40 |

$30 to $48 |

$26 to $36 |

|

45 |

$41 to $61 |

$37 to $44 |

|

50 |

$72 to $95 |

$58 to $78 |

|

55 |

$147 to $211 |

$112 to $150 |

|

60 |

$331 to $496 |

$234 to $297 |

|

65 |

$690 to $1,029 |

$466 to $635 |

|

70 |

$1,664 to $2,303 |

$906 to $1,336 |

The highest and lowest premiums shown are from the Australian insurance brands compared by our online quoter: AIA, Acenda (formerly MLC), ClearView, Encompass, Futura, MetLife, NEOS, OnePath, TAL and Zurich.

The premiums shown do not include any health discounts or rewards offered by the insurers. The premiums also do not include the 10% cashback or 5% ongoing discount offered by Insurance Watch.

Premiums for smokers can be up to double those for non smokers. The good news is that if you give up smoking (including vaping and nicotine patches) for more than 12 months, you can request that your insurer change your premium to non-smoker rates, which will be a substantial reduction.

Other factors affecting the cost of Life insurance

In addition to the above, occupation can also be a factor resulting in a higher life insurance premium if your job is judged to be hazardous by the insurance company i.e. you work at heights or handle explosives.

Also certain pre-existing medical conditions, such as diabetes, heart conditions and even a high Body Mass Index, can result in an insurer imposing a “loading” i.e. a higher premium, after they have assessed your application for life insurance.

Another factor affecting the cost of a life Insurance policy is how it is distributed – i.e. via a broker/adviser, super fund or direct to the public.

“Direct” life insurance policies can be as much as 2 to 3 times more expensive than those from the insurers compared on the Insurance Watch website. “Direct” products tend to require large marketing budgets and offer lower medical requirements at time of application.

Super funds also offer insurance to their members at group rates which may be beneficial to some members, although their premiums are not always cheaper than retail policies from brokers/advisers. The insurance options available through super funds are also limited and can have a number of disadvantages.

Why does life insurance cost less for females?

From these graphs it can be seen that females enjoy much lower life insurance premiums than males.

The main reason for this is the different mortality rates for males and females.

In 2016 the AIHW found that the median life expectancy for females was 84 years of age compared to 78 years of age for males.

Why does life insurance get expensive as you get older?

In Australia, most life insurance premiums are Variable Age Stepped, which means they will change over time with your age to reflect the risk of you making a claim.

Generally this means that premiums will be increasing over time. However for a period from the early 20s until the early 30s life insurance premiums tend to decrease, as the risk of death from motor vehicle accidents and self-inflicted harm reduces.

Thereafter, premiums increase with age due to the increasing incidence of death from health conditions such as cancer and coronary heart disease. At first they rise gradually, but after the age of 50 premiums rise sharply, primarily reflecting increased mortality rates.

How do you manage rising life insurance costs?

Rising age-stepped premiums need to be seen in the context of your changing needs over time. The need for life insurance tends to peak for most people around age 35 to 50. So as premiums increase rapidly past age 50 you may be able to reduce your cover amount as your risk exposure reduces (see below).

A level (Variable) premium can help to smooth out the age effect of rising premiums. A level (Variable) premium taken out while in the early 30s and held to age 65 or 70 can result in significant premium savings compared to a Variable Age Stepped premium.

Shopping around can ensure that you are not paying more than you need to. As can be seen from the graph above, the highest premium for $1M life cover for a male 60 year old non smoker was $496 per month, whereas the lowest premium was $331 per month, or 33% less. Avoiding a “Lazy Tax” can result in significant savings, particularly over the age of 50.

How much Life and TPD insurance cover do I need?

Your need for life and TPD insurance will vary at different stages in your life.

When you take out a mortgage or have children your family’s finances may be vulnerable to a loss of income resulting from an unexpected injury, illness or death.

On the other hand, as you approach retirement you are more likely to have accumulated assets, including superannuation savings, and paid-off liabilities and your children are more likely to have left home.

This can mean that your need for life or permanent disability insurance is reduced as you get older. However, there are also many reasons why you may have insurance cover in your 50s and 60s.

Can I have multiple Life and TPD insurance policies?

It is possible to have multiple Life and TPD insurance policies. Many people will have automatic or default Life insurance and TPD insurance cover provided by their employer or superannuation fund and may also have other policies they have taken out personally.

Each policy may have been taken out for a different purpose and/or have different beneficiaries (e.g. for estate equalisation purposes). There will be different tax implications for the benefits paid by retail policies and super policies. Some people prefer to diversify their cover across several different insurers, although this will usually cost more than consolidating the cover with one insurer due to the discounts provided for larger sums insured.

In the event of your death, terminal illness or total and permanent disability, you or your family will be able to claim against all valid policies. However it is important to ensure when you are taking out a new policy you disclose any other existing policies. This is so that the insurance company can assess your application against their maximum cover limits

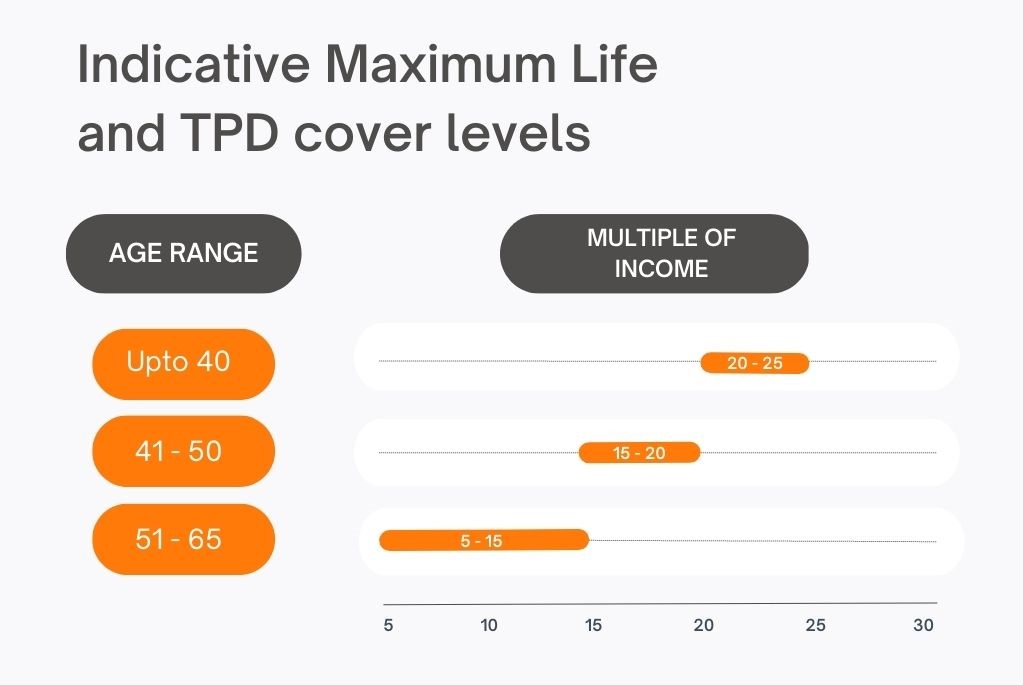

What is the maximum Life and TPD insurance cover I can have?

While the major life insurance companies compared on this website have no absolute limit on the amount of life insurance cover an individual can apply for, there is usually a limit of $3M to $5M for total TPD cover (lower limits may apply on products marketed direct to the public).

The insurer will also consider whether your total amount of cover (your existing cover plus the amount you are applying for) is reasonable relative to your level of income. To determine this they will generally use an income multiple based on your age

If your insurance needs are higher than the amounts implied by these multiples this does not mean that your application will be refused. You may however be requested to provide more information about how you determined your cover amount. This may include details regarding your current level of debt, number of dependants and their age, your income and the income of your spouse (which may be affected by your death or disability if, for example, they are required to care for children).

If you do not have an income because you are not working or you are performing home duties you can still apply for life and TPD insurance, however cover limits may apply.

Will my Life insurance or TPD insurance claim be paid?

Total claims paid by life insurers in 2022 amounted to $11.2 billion according to data from CALI.

A review by ASIC in 2016 found that on average approximately 90% of all claims submitted were paid – of these 96% of life insurance claims and 84% for TPD insurance claims were paid. The main reasons for declined claims were non-disclosure at time of application and ineligibility due to policy definitions, limitations, exclusions or pre-existing conditions.

In March 2019 APRA and ASIC released for the first time claims acceptance rates and average claims times on an individual insurance company basis. With more than 5 years of claims data now available, insurers who under perform industry averages for processing claims will be accountable to both consumers and the regulators.

If you have taken out a Life/TPD insurance policy through Insurance Watch and you need to make a claim we will help you during the claims process.

Recent Life/TPD insurance claims paid to Insurance Watch customers

| $441,000 | Death of a 32-year-old construction worker as a result of a work accident |

| $1,251,300 | Death of 40-year-old nurse as a result of illness |

| $309,900 | Terminal illness of a 48-year-old university lecturer |

| $560,000 | Death of 48-year-old management consultant after accident working on a car at home |

| $210,600 | Terminal illness of 52-year-old homemaker |

| $350,000 | Death of 52-year-old bank manager as a result of illness |

| $1,870,500 | Terminal illness of 53-year-old doctor |

| $1,276,300 | Death of 67-year-old taxi driver as a result of illness |

Other Topics

The initial sum insured may be eaten into by inflation as time passes.

Most companies allow escalation of the benefit in line with inflation or a set percentage increase, without the need for further medical examinations or paperwork.

The increase in the benefit each year is optional and can be refused.

What appears to be a cheap premium today may turn expensive if the insurance company you are with penalises older age groups more than other companies.

Some companies offer discounts to new customers but after the first year or two these drop off and you can find yourself on a higher premium.

Other companies offer loyalty discounts, which can make the overall cost over 5 or 10 years significantly less.

If you use the Compare Insurance Quotes Online feature of this website, you can ask us to provide premium projection graphs (based on the current premium structures) over 5, 10 or 20 years so that you can compare the competitiveness of policies over the longer run.

Beware the so called “cheap” offers of insurance which are advertised heavily.

Remember the size of the premium varies directly with the amount of cover taken out.

Small premiums usually mean small amounts of cover eg $50,000 to $100,000 which in the event of your death may be grossly inadequate to meet your family’s needs.

To compare like amounts of cover from a range of top insurance companies use the Compare Insurance Quotes Online feature.

Your superannuation fund may include automatic cover for term life or TPD disability insurance up to a certain amount. However this default level of cover may be inadequate for your needs and in some cases the amount will reduce as you get older. The super fund may offer a facility to “top-up” your cover for an additional cost but this may require underwriting of your health.

Due to the “pooled” or group nature of this form of insurance, the default premium charged will generally favour the older members of the Fund or those with pre-existing health problems who would normally be penalised by life insurance companies. Healthy, younger members are in effect subsidising these groups and may find purchasing cover as an individual from an insurance company to be more cost effective.

Other issues to consider are: potential delays in the payment of claims, the right of the Trustees of super funds to override your choice of beneficiary in some circumstances and the lump sum tax which will apply to any payout where the beneficiary is not a dependant (unlike for a non super insurance company payout). These and other issues are considered in our list of potential disadvantages of superannuation insurance compared to policies outside super.

Of course, if you are self employed or run your own Self Managed Super Fund (SMSF) you will need to ensure that insurance is part of your business planning.

Check the terminal illness section of your life insurance policy.

Does the company offer early payment of all or part of your benefit in the case of the diagnosis of a terminal illness?

Does the insurer require that you to have 12 or 24 months left to live? The longer the better as it means you will receive the money earlier.

Receiving a terminal illness payout could significantly improve your quality of life and ease the burden of medical bills and other commitments on your family prior to your death.

TPD definitions do vary between companies but the differences between the two types of TPD cover can be broadly described as follows:

Own Occupation – You will be paid if by reason of illness or injury you are unable/unlikely to work ever again in your own or normal occupation.

Any Occupation – You will be paid if by reason of illness or injury you are unable/unlikely to work ever again in any occupation for which you are reasonably suited by education, training or experience.

“Own” occupation definitions are generally preferable given that an injury such as loss of one hand may disable a surgeon under such a definition, but under an “Any” occupation definition may leave him able to perform the duties of a GP at a much reduced income and therefore not qualify for the benefit. However the “Own” occupation definition is more expensive and may not be available for all occupations.

Some companies offer other “home duties” and “modified” definitions of TPD.

Usually only ONE TPD benefit is ever payable to an individual and payment of a claim for TPD will usually void your linked death cover.

After a payout you may become uninsurable and no longer able to obtain life insurance, TPD insurance, trauma insurance or income protection insurance cover from any insurer. In this case it is important to have sufficient cover to enable you to live out your remaining life on the proceeds of the claim.

Some insurers offer a TPD buyback option (this may be included at no cost or require an additional premium) which enables the death cover to be reinstated twelve months after a TPD claim has been paid, making it possible to make another claim for death under the policy.

Frequently

Asked

Questions

What is TPD insurance?

TPD (Total and Permanent Disablement) insurance provides a cash lump sum if you suffer a permanent disability arising from an illness or injury and this prevents you from being able to work again. Usually there will be a requirement for you to have been off work for a period of at least three or six months before a claim can be considered. There are different types of TPD insurance including: Any Occupation, Own Occupation, Home Duties and ADL (Activities of Daily Living).

What is linked Life and TPD insurance?

TPD cover is usually taken out as an extension or extra cost option on a Life insurance policy and the Life and TPD insurance covers are “linked”. This means the insurer will only pay on the first to occur of death or TPD and a TPD claim will extinguish the linked Life cover up to the amount paid out. If the policy has a TPD life cover buyback option the Life cover may be restored 12 months after the TPD claim. Standalone TPD cover can also be purchased.

Do you need TPD insurance?

If you are permanently disabled and unable to work again you will not have your income to meet living expenses and debt repayments. There may also be additional costs for medical fees, nursing care and home modifications. A TPD insurance payout can be used to repay debt and provide a lump sum that you and your family can draw down on to maintain your living standard. Use our Insurance Needs Calculator to estimate how much TPD cover you may need.

How is TPD insurance different to Income Protection insurance?

TPD insurance is intended to cover permanent disabilities. It does not provide cover for temporary disabilities, such as short term injuries or illnesses, where you would be expected to recover and be able to return to work. Income Protection insurance on the other hand can be used to cover both short term and long term illnesses or injuries, depending upon the benefit period chosen. Unlike TPD insurance, Income Protection insurance does not pay a cash lump sum, but rather a monthly payment.