On 2nd December 2019 APRA announced it will be intervening in the life insurance market in response to the failure of the industry to take action to stem losses from individual disability income insurance (DII) policies (more commonly known as income protection policies).

Why is APRA intervening in the Income Protection market?

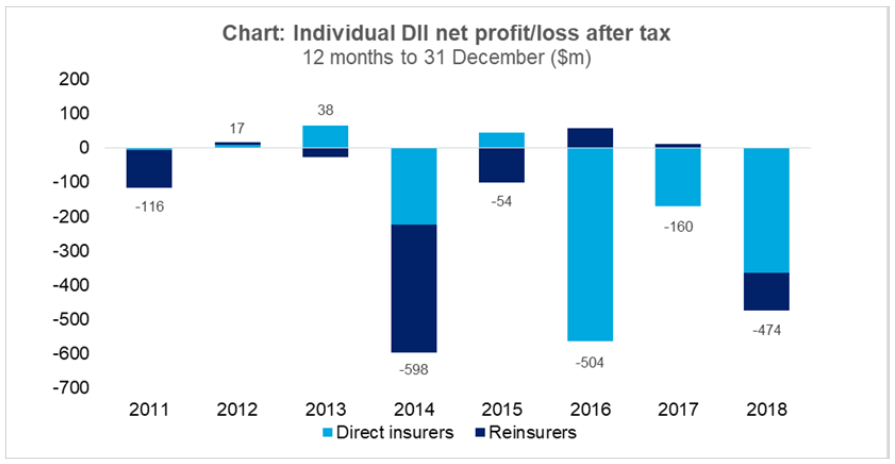

In May 2019 APRA issued a warning to insurers that urgent action was needed to address the collective losses of around $2.5 billion over the last 5 years from the sale of DII policies.

Source: APRA – Thematic Review of Individual Disability Income Insurance – Phase Two (2 May 2019)

Despite insurers inflicting “significant and frequent premium increases” on policyholders, total accumulated losses were reported to have blown out further to $3.4 billion by the end of September 2019, prompting APRA to act.

“Insurers know what the problems are, but the fear of first-mover disadvantage has proven to be an insurmountable barrier to them making the necessary changes. By introducing this package of measures, APRA is forcing the industry to better manage the risks associated with DII and to address unsustainable product design features – or face additional financial penalties,” according to APRA Executive Board Member Geoff Summerhayes.

APRA will apply a capital charge to all insurers which will remain in place until it observes “sufficient and sustained progress” against its expectations.

What changes are APRA requiring insurers to make?

APRA has signalled it expects insurers to make the following changes to new income protection policies:

By 31st March 2020:

- Cease offering Agreed Value income protection policies

By 1st July 2021:

- Base cover on income at time of claim, not older than 12 months. This may mean that indemnity policies where income is measured as the highest 12 month period over 2 or 3 years may no longer be issued.

- Where additional features and benefits are offered, limit the income replacement ratio to 100% of earnings at time of claim for first six months and thereafter 75%. This could lead to policies with fewer extra benefits being issued.

- Restrict guaranteed renewability to 5 years. It is proposed that the terms and conditions of policies would be able to be reset after 5 years and any changes to the policyholder’s occupation and financial circumstances could be considered at that time.

- Other measures to control the risk of benefit periods greater than 5 years e.g. applying stricter disability definitions.

APRA is inviting feedback from the insurers on some of the changes scheduled for next year and will finalise its position by 30th June 2020.

Why does APRA believe that these changes are necessary?

APRA believes that the design of income protection policies has moved away from the fundamental principle of Indemnity i.e. that the benefit under an insurance policy should not exceed the economic loss of the policyholder.

If the features of an insurance policy are too generous they may encourage moral hazard. In the case of income protection policies, if the benefit paid is more than the income which has been lost this may provide a disincentive to return to work.

These product features combined with the long benefit periods on offer are having an adverse financial impact on insurers. APRA is concerned that if the current product offerings are not modified the cost of income protection may become unaffordable in Australia.

Who benefits from Agreed Value Income Protection insurance?

Agreed Value policies are the first to be targeted by APRA. An Agreed Value policy allows a policyholder to provide financial evidence of their income at application time and have their monthly benefit “agreed” or “guaranteed” so that they will be paid this amount even if at claim time their income is lower.

This is different to an Indemnity policy where the payment will be limited to no more than 75% of income at the time of claim. Indemnity income protection policies are around 20% cheaper than Agreed Value policies.

Agreed Value policies provide certainty of payment at claim time. This is particularly valuable for:

- self employed persons who have fluctuating incomes

- contract workers who may have breaks between contracts

- young women who may have a break from employment to have a family

- anyone who may become unemployed involuntarily

- those taking unpaid leave for study or travel purposes

What is “wrong” with Agreed Value Income Protection policies?

APRA believes that, in order to reduce the risk of moral hazard, claim payments should only be linked to income at the time of the claim.

With an Agreed Value policy it is possible that the agreed monthly benefit may exceed the income of the policyholder over the 12 months prior to the claim.

This may be the case because the policyholder has changed to a lower paid job or is working fewer hours. If the policyholder is self-employed their business could be experiencing a downturn. Also automatic annual CPI indexation could cause the agreed monthly benefit to increase at a faster rate than actual income.

Where the benefit exceeds the income lost APRA argue there may be a disincentive to return to work.

Update – Options following the Withdrawal of Agreed Value Policies

Since 31st March 2020 insurers have stopped issuing Agreed Value income protection policies.

What options does this now leave the self-employed and others who might have employment breaks or fluctuating income?

Until the next set of changes (due to take effect 1st July 2021) it is possible to take out policies with the following features:

- Guaranteed renewable to age 65

- Indemnity definition of pre-claim income which uses the highest 12 months’ income over the last 2 or 3 years, giving some protection against a fluctuating income

- Additional benefits such as specified injury benefit, trauma benefit, family support/housekeeping benefits to boost the total amount received

- Hours and Income definitions of Total Disability to give greater flexibility at claim time

To identify income protection policies with these features use Compare Quotes and then choose View or Compare benefits. To obtain advice on which policies are suited to your situation please go to Get Advice and complete our online Fact Find.