The Australian Financial Complaints Authority (AFCA) has released a detailed breakdown of the complaints received up to 30th June 2020.

The data can be found on the AFCA Datacube, an online comparative reporting tool, which shows how financial organisations are performing in handling complaints. The tool can be used to see the number of complaints lodged against a firm and how long it takes to respond to and resolve a complaint.

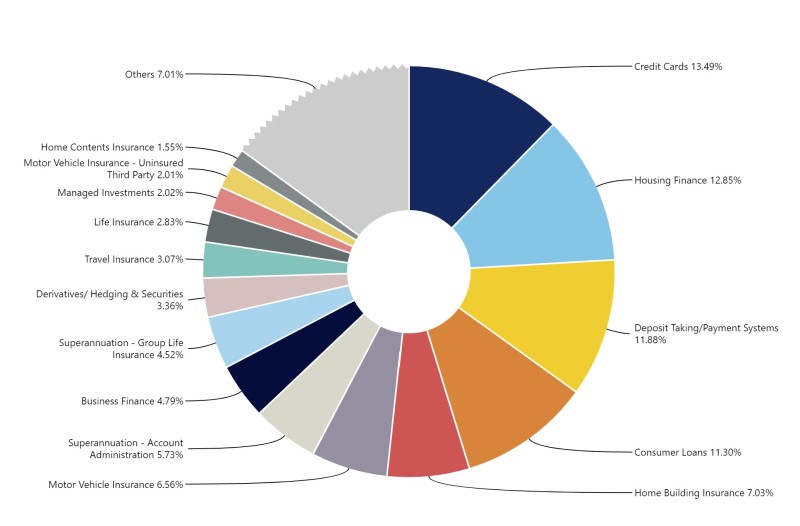

In the latest data complaints against life insurance companies comprised only a small percentage of the total received – only 2.83%. On the other hand AFCA found there was a spike in complaints in 2020 relating to travel insurance and early access to superannuation due to COVID-19.

Total Complaints received 12 months ending 30 June 2020

Source: AFCA Datacube

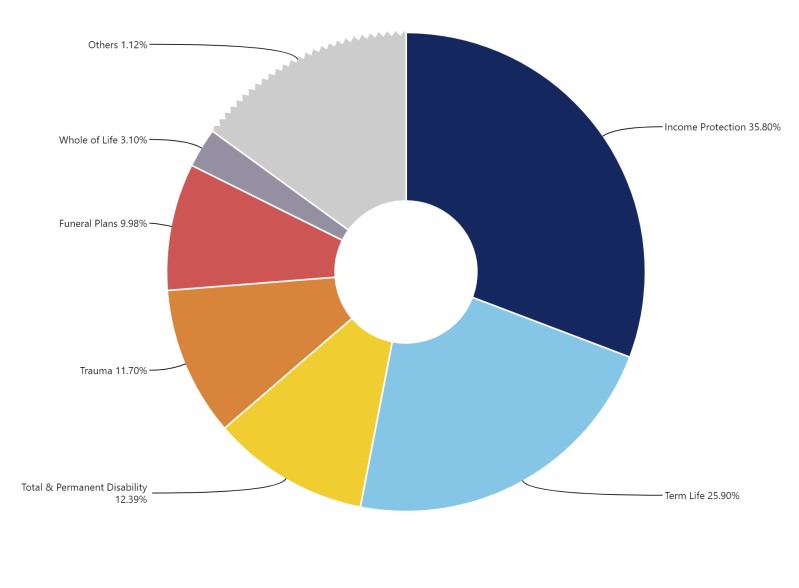

Of the total life insurance related complaints received, the type of insurance with the most complaints was Income Protection at 35.8%. This was followed by Term Life at 25.9%, TPD at 12.39% and Trauma 11.7%.

Breakdown of Life Insurance Complaints

Source: AFCA Datacube

The AFCA Datacube also gives the ability to view complaint numbers at an individual insurer level. The Life insurers with the most complaints over the 12 month period were as follows:

| Insurer/Financial Firm | Complaints Progressed |

| TAL Life Limited | 141 |

| AMP Life Ltd | 113 |

| OnePath Life Limited | 106 |

| Westpac Life Insurance Services Limited | 97 |

| MLC Limited | 87 |

However, the number of complaints should be considered in proportion to the total number of policies issued by an insurer.

To try to measure the likelihood of a dispute arising with an insurer, APRA uses a dispute lodgment ratio. This calculates the number of disputes per 100,000 lives insured. To see how individual insurers perform on this measure go to Claims Statistics.