Guide to the Pros and Cons of SMSF Life Insurance

The following is a summary of the key considerations when taking out SMSF insurance policies:

What are the main benefits of SMSF insurance policies?

- Insurance protection for members

- Tax effectiveness vs personal ownership

- Reduced cashflow pressure by using the funds in the SMSF to pay premiums

What are the potential drawbacks of SMSF insurance policies?

- Premiums can be higher than the group rates provided by large super funds

- Tax can be payable on some Life insurance and TPD benefits under super

- Super contributions used to pay insurance premiums count towards Super Cap

- Using super balance for premium payments erodes retirement savings

- Super policies have restricted features and benefits compared to policies outside super

Which insurance policies can a SMSF pay for?

- Life insurance

- TPD insurance with an Any Occupation definition

- Standard Income Protection insurance policies

Which insurance policies can’t be paid for by a SMSF?

- TPD insurance with an Own Occupation definition

- Trauma insurance

- Comprehensive Income Protection insurance policies

5 important tips for SMSF Trustees regarding insurance:

- Consider the insurance needs of each member and document this annually (or risk being fined)

- Obtain quotes for how much insurance will cost within your SMSF (including any health loadings) BEFORE moving your super

- Investigate whether existing insurance policies (both inside and outside super) should be continued

- Ensure your SMSF is properly recorded as the policy owner and payor of premiums so your SMSF can claim a tax deduction for the premiums

- Keep your SMSF beneficiary nominations up to date as these will apply to the death benefit (be aware of any tax implications – see below)

How to get insurance quotes for SMSF members

Go to Compare Quotes Online to view SMSF insurance quotes and apply online and qualify for the Insurance Watch 10% Cashback Offer.

All of the Life insurance and TPD (Any Occupation) insurance policies from the 10 insurance brands covered by our DIY Online Quote Comparison Tool are available to be purchased by a SMSF (there may be some benefits excluded and definitions altered to meet superannuation legislation requirements as specified in the insurer’s PDS).

In addition many of the “Standard” Income Protection policies quoted can be purchased in a SMSF version (again some benefits and definitions are changed to meet superannuation legislation requirements).

Premiums are generally the same whether a policy is to be owned by you or your SMSF, and in most cases the premiums through Insurance Watch premiums are substantially cheaper than purchasing “direct” life insurance policies.

Insurance Watch also has advisers who are SMSF life insurance specialists. If you would like to receive personal advice regarding the suitability of SMSF insurance for your particular circumstances please complete our online Fact Find at Get Advice.

How to set up insurance policies for SMSF members

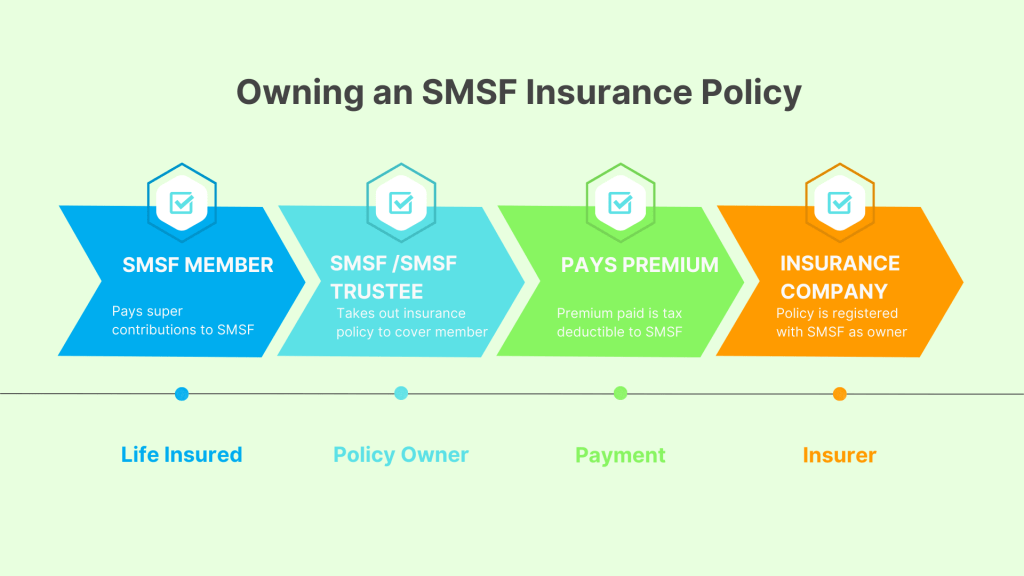

Quotes will need to be calculated separately for each member and a separate application submitted. When asked during the application process who will own the policy “Self Managed Super Fund” should be selected so that the correct paperwork will be sent for signature by the SMSF trustees or directors (as relevant).

It is important to ensure that policies are set up correctly with the individual trustees of the SMSF (or the trustee company if applicable) listed as the policy owners “as trustee for” the superannuation fund. It is also important that the premiums are to be paid from the SMSF bank account in order for a tax deduction to be claimed.

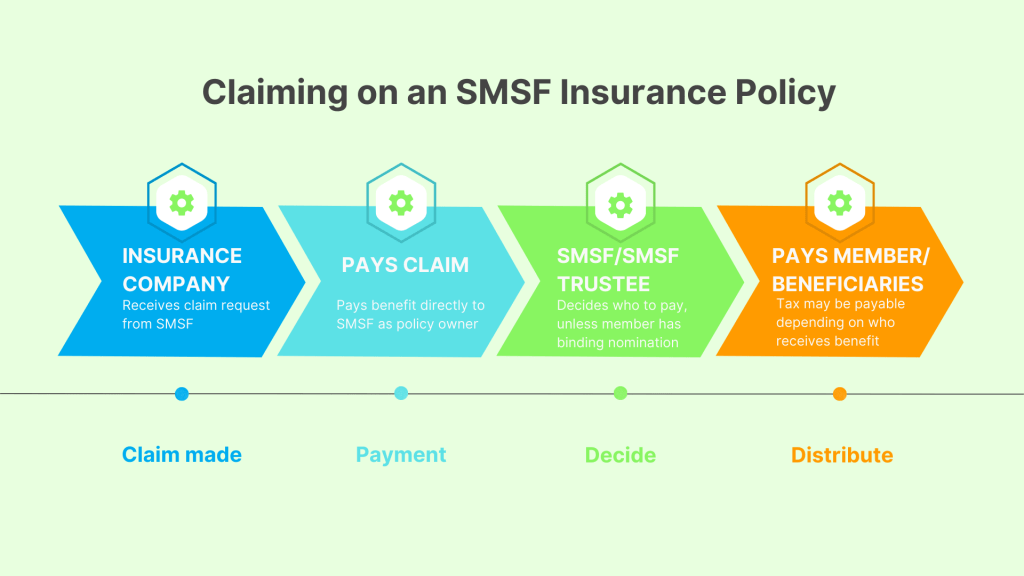

In the event of a claim the insurance company will pay the benefit directly to the SMSF. Members need to have a valid and binding beneficiary nomination registered with their SMSF if they wish to direct how the funds will be distributed on their death. Without this, the SMSF trustees will have discretion as to how to allocate the funds.

Why should I have insurance within my SMSF?

The number of Self-Managed Super Funds (SMSFs) in Australia has been growing strongly. The latest figures from the ATO show that at the end of March 2023 there were 606,217 SMSFs in Australia with 1,136,234 members and more than $855 Billion in assets.

The Cooper Review into the superannuation system in June 2010 found that less than 13% of SMSFs had insurance for their members.

In August 2012 as part of its move towards “Stronger Super” the government introduced superannuation regulations requiring trustees of SMSFs to consider the insurance needs of their members.

As a result SMSF trustees have a legislative obligation to consider whether to take out insurance cover for each of their members and review this annually.

In meeting this requirement the Trustees should consider the personal circumstances of each of the members of the fund including their income, assets and liabilities, any existing insurance cover they have and how they or their family would be impacted by their death and disability – see our Life Insurance Needs Calculator.

It also may be relevant to consider how the insurance could be used by the fund to extinguish liabilities or avoid having to dispose of a large asset to pay a benefit to a member.

This insurance strategy needs to be documented at least annually in the SMSF investment strategy or in the minutes of a trustee meeting. There are penalties which will apply if the trustees fail to address insurance in their SMSF.

Insurance should be an important consideration when deciding whether or not to set up a SMSF. There may be reasons why members would be better off retaining their existing insurance covers (super and non super) rather than taking out new insurance policies within their SMSF.

Therefore, before cancelling any existing insurance policies or closing any super accounts which include insurance cover, the availability and cost of insurance cover through a SMSF should be established.

Below we consider some of the pros and cons of a SMSF purchasing insurance policies for its members.

Advantages of having insurance owned by your SMSF:

- Protection of members

Where a SMSF member is still working and accumulating wealth their death or disablement is likely to have a devastating effect on their family, particularly if they have debts and dependant children. In this case there may be a strong need for Life insurance and TPD insurance which will provide a lump sum payment should this happen. For members who are retired with sufficient funds in their super fund to provide for their dependants in the event of their death or disablement this insurance may be less important.

- Tax effectiveness

For SMSF members it can be tax effective for their super fund to purchase Life and TPD insurance policies on their behalf rather than purchase them personally. As an example, assume your Life and TPD insurance premium costs $1000 and you are earning more than $120,000 per annum (meaning your marginal tax rate is 39% including Medicare levy).

If you pay for your premium personally you will need to find $1000 in after tax dollars. This means you will need to earn an additional $1639 gross income (before tax) in order to generate $1000 in after tax dollars to pay the insurance premium.

Alternatively, you could make an additional super contribution of $1000 gross income (e.g. by salary sacrifice) to your SMSF so it can purchase the policy. Your SMSF will need to pay 15% super contributions tax on the $1000, but it can also claim a 15% tax deduction for the insurance premium, so no net tax is paid. Therefore the cost of the insurance ends up being $1000 not $1639 in before tax terms.

There are some caveats. If you breach the $27,500 concessional super contributions cap you could end up being taxed much more. The benefit will not be as great for those on a lower marginal tax rate or for those earning above $250,000 (and therefore subject to the additional 15% super surcharge). Income protection premiums are already fully tax deductible outside of super (unlike Life and TPD premiums) so there is no tax advantage in having your super fund own these policies.

- Cashflow conserved

If the insurance premiums are paid from existing funds in the SMSF the members will not have to find the cashflow to fund the premium payments each year. However these payments may have an unacceptable impact on the member’s retirement balance (see below).

Potential disadvantages of having insurance in your SMSF:

- Cost and Pre-existing Health Conditions

If you are switching your superannuation balance from an existing superannuation fund to your SMSF you should check whether it is possible to maintain your existing insurance benefits by leaving a small balance (under “Protecting Your Super” this will need to be at least $6,000) in your existing fund.

The insurance premiums offered by large superannuation funds are group rates and are likely to be cheaper than the individual policies your SMSF can purchase. This is particularly the case if you suffer from any health conditions which may result in exclusions or premium loadings being applied to your SMSF policies. Large super funds sometimes offer default levels of cover without medical underwriting and while this amount of cover may not be sufficient in itself it can be used as a base which is topped up with cover in your SMSF

- Super cap limits

From 1 July 2021 tax advantaged or concessional contributions to super are limited to $27,500 per annum. If you increase super contributions to your SMSF to cover your insurance premium payments you need to remember that this increase will count towards this limit. If this results in you exceeding the concessional limit you will be charged a penalty tax on any excess.

- Reduced Retirement Balance

If you do not increase your super contributions to cover the insurance premiums being deducted by your SMSF then the premiums will reduce the investment balance you would otherwise have available to earn a return for your retirement. The Productivity Commission Inquiry in 2018 found that in some cases this can reduce retirement balances by 14%. This impact can be reduced by increasing super contributions, as long as contribution caps will not be exceeded.

- Tax payable

Tax can be payable on Life insurance and TPD insurance payouts from super under certain circumstances. To find out more read below the sections on SMSF Life insurance and TPD insurance

- Full Featured Cover is not available

Unfortunately superannuation legislation restricts the cover a SMSF can purchase. This means that trauma insurance, Own Occupation TPD and comprehensive income protection cover are not available to be purchased. Also SMSF life insurance, TPD (Any Occupation) and standard income protection policies miss out on some of the benefits and features offered by the equivalent policies outside of super. However there is a way to access these additional benefits by “Superlinking” the extra benefits and paying a small part of the premium personally. To find out more read below or Contact Us.

What types of insurance can a SMSF purchase?:

On 1 July 2014 regulations were introduced requiring that all new insurance policies issued to SMSFs be consistent with the Superannuation Industry (Supervision) regulations (SIS) conditions of release which are death, terminal illness, total and permanent disablement and temporary incapacity.

As a result Own Occupation TPD,Trauma and Comprehensive Income Protection policies can no longer be purchased by SMSFs.

This change was introduced because if a member suffered a trauma condition (such as a heart attack, cancer or stroke) or an Own Occupation disability (as opposed to Any Occupation disability) or received a specific injury benefit under an income protection policy, then these benefits may not have been able to be paid to the member. Although the insurer paid the benefit to the SMSF, the trustees could have been unable to pass this on to the member if a condition of release was not met and the funds could have become “trapped” in the fund.

Although Life, TPD (Any Occupation) and Standard Income Protection policies can still be purchased by SMSFs, the cover will have some restrictions compared to the same cover purchased outside super. There are also tax and other considerations which need to be taken into account.

SMSF Life Insurance:

Life insurance policies can be purchased by a SMSF for the members of the Fund and the premiums will be deductible expenses to the Fund.

However the following needs to be considered:

- Cover restricted to core benefits only

Due to super legislation a life insurance policy owned by a SMSF will usually only cover the core benefits of death and terminal illness. Ancillary benefits which are available outside super, such as funeral advancement, grief counselling, financial planning and accommodation benefit will usually not be be offered. Also the terminal illness definition will be modified to conform with the SIS definition e.g. two doctors, not one, will be required to confirm the condition.

- Trustee discretion and beneficiary nominations

When a SMSF owns a Life insurance policy and the person insured dies, the insurance company will pay the death benefit under the policy directly to the fund. The trustees will then have discretion as to how to distribute the funds. To direct the trustees as to how to distribute the proceeds of the insurance policy on their death members will need to ensure that they have registered with their SMSF a binding beneficiary nomination

- Tax Payable by some beneficiaries

Unlike Life insurance policies outside super where the payout to beneficiaries is tax free, Life insurance payouts from super funds can be subject to tax under certain circumstances according to the ATO. While death payments to a member’s spouse will be tax free, if a beneficiary is over eighteen and not a financial dependent they may have to pay tax on the amount they receive. This could mean that adult children could be taxed at rates of up to 32% (including Medicare levy). This tax liability can be managed by either increasing the amount of cover to compensate for the tax payable or by transferring the cover out of the super fund when children turn eighteen.

SMSF Total and Permanent Disablement (TPD) Insurance:

Any Occupation TPD insurance policies can be purchased by a SMSF for the members of the Fund and the premiums will usually be deductible expenses to the Fund.

The following needs to be considered:

- Only Any Occupation TPD available

“Any Occupation” TPD most closely mirrors the definition of TPD under superannuation legislation and means that you must be unlikely due to sickness or injury to ever work again in any occupation you are suited to by training, experience or education. However when a SMSF purchases TPD cover there will also be an overriding requirement that the policy satisfies the SIS definition of Permanent Incapacity. This means that claims for lesser disabilities, such as a partial payment for loss of one limb or sight in one eye, which might be paid under non super policies will not be allowed where the policy is owned by a SMSF.

- Superlinking Own Occupation TPD

If your SMSF has members who are highly paid or perform highly specialised occupations they may prefer to have an “Own Occupation” definition of TPD insurance where a benefit is paid if you are unable due to sickness or injury to ever work again in your own occupation (usually the occupation you are currently performing). Under this definition the insurer will pay a benefit if you are permanently unable to perform your own occupation, even though you may be able to perform the duties of another lower paid job.

For example a surgeon who injures his hand may not be able to operate again but he could be a GP at a considerably lower income. Normally this would mean that if members wanted Own Occupation TPD they would need to purchase the policy outside of the SMSF.

However innovation by insurers has led to the introduction of “superlinked” policies where a super fund owned Any Occupation TPD policy can be linked to an Own Occupation TPD policy owned outside of super resulting in only a small amount of premium required to be paid personally by the individual. If this is of interest please ask one of our advisers to structure a policy for your SMSF by completing your details at Get Advice.

- Tax may be payable on a lump sum TPD payout

Unlike a TPD policy held outside super where the insurance payout is tax free, a TPD payout which is withdrawn from a superannuation fund is subject to tax under the ATO lump sum superannuation payment rules. A tax rate of 22% (including Medicare levy) will usually be applied to the taxable portion of the withdrawal unless the member is aged over 60 (depending upon their preservation age). How much will be taxed will depend on the member’s years of service and how long they have to retirement. As a general rule the larger the service days and the closer to retirement the higher the amount which will be taxed. To compensate for this tax a higher amount of TPD cover may need to be taken out than if the policy was held personally.

SMSF Income Protection insurance:

Income protection insurance will provide your members with a monthly payment if they are unable to work temporarily due to sickness or accident.

The following needs to be considered.

- No Tax Advantage

There is unlikely to be any tax advantage to members of having their Income Protection insurance policies owned by their SMSF. If they own their policy personally they are likely to be able to claim a tax deduction for most of the premium i.e. they will receive a refund equivalent to the marginal tax rate paid on the deductible portion of premium. Where the SMSF pays the premium it will claim this as an expense which effectively means no tax will be payable.

It may still be attractive for some SMSF members to have their income protection policy owned by their SMSF for cashflow reasons, so that the accumulated funds in the SMSF can be used to pay the premium and not their own private cashflow. However the detrimental effect of the premiums in reducing the super balance available at retirement would also need to be considered.

- Only Standard Income Protection cover available

Following 1st July 2014 only “standard” Income Protection insurance policies are able to be purchased by SMSFs and these must comply with the conditions for temporary disability payments under superannuation legislation. While policies purchased by a SMSF will provide cover where a member is unable to work at all due to sickness or injury, they may not be able to offer the additional features and benefits which policies outside of super can, such as:

- Hours Definition of Total Disability

- Income Definition of Total Disability

- Partial disability from day one

- Specific injuries benefit

- Trauma benefit

- Nursing care

- Housekeeper care

- Family support benefit

- Rehabilitation cost reimbursement

- Travel costs reimbursement

In addition a member may not be able to claim if they become sick or injured while unemployed, unlike under policies held outside super. Benefit payments may also be offset for any sick leave payments received.

Again innovation by some insurers has enabled clients to still be able to access the benefits of a Comprehensive policy while the majority of the premium is paid through their SMSF. This is achieved by “superlinking” Standard and Plus policies – a Standard policy, which is super compliant, is owned and paid for by the super fund and the “extra” benefits associated with a Plus policy are owned and paid for by the member outside of super.

If you have a member who is interested in having the benefits of a comprehensive Income Protection insurance policy but wants their SMSF to pay for the bulk of the premium please provide your details to one of our advisers at Get Advice and they will structure this cost effectively for them.

- Agreed Value Policies not available

SMSFs are only able to purchase income protection policies which are Indemnity policies and not Agreed Value. Agreed Value policies are attractive to professionals and self-employed individuals who have income which can fluctuate from year to year because they pay the monthly benefit on the policy schedule regardless of what your income is at claim time. This contrasts with indemnity cover which may pay you less if your income has dropped since you took out your policy. From 1st April 2020 Agreed Value Income Protection insurance policies ceased to be issued.

Therefore if a member has an existing Agreed Value policy then, before taking out an Indemnity SMSF income protection policy, they should consider whether they are likely to have a fluctuating income or have a break in employment (e.g. for maternity leave) which would mean they would be better off retaining an Agreed Value policy outside of super.

This is a complicated area and the above information is of a general nature only. If you need help with your personal situation you should seek professional advice. Please contact one of our advisers at Get Advice.

Related Questions:

Can a SMSF pay for life insurance?

A SMSF can pay the premiums for life insurance for its members. It can also pay the premiums for some types of TPD and income protection cover. However these payments will reduce the funds available for investment and therefore member retirement balances,

Is life insurance compulsory for a SMSF?

SMSF trustees have a legal obligation to consider the insurance needs of their members. This may result in the SMSF taking out insurance cover for members. However, if the members have insurance policies elsewhere or their personal circumstances do not require insurance, the trustees can meet their obligations by documenting this.

Is life insurance tax deductible in a SMSF?

A SMSF can usually claim a tax deduction for the premiums for Life and TPD (Any Occupation) policies. Individuals cannot generally claim a tax deduction for these premiums so this can make super ownership more tax effective compared to buying these covers personally.

Can I claim from 2 life insurance policies?

You are able to take out more than one life insurance policy i.e. one through your super fund and one outside super. In the event of your death both policies can pay a benefit. When you apply for insurance you will be asked to disclose what other insurance policies you hold.